Finance

From Pocket Money to Financial Mastery: 10 Steps to Teach Kids Money Management

Do you remember the first time you held a coin or a note in your hand? How did you learn about money management - at home, at school, or through the school of hard knocks?

Top 8 Investing Mistakes and How to Avoid Them?

In the ever-evolving landscape of financial independence, one phrase rings true more than ever: "Make your money work for you." The bedrock of this mantra is a concept familiar to all - investing.

Navigating the Stock Market: Tips for Successful Trading and Investing

The stock market is an efficient and impactful way to invest. It offers you exciting financial adventures with the opportunity to achieve financial stability and a balanced lifestyle. It can help you with financial security with many options and good luck for your future. However, its many dimensions, complex concepts, and constantly changing numbers and market values can make it difficult for beginners. They are hesitant to invest their money in the stock market because they need to learn how it works or how to make big money by learning basic skills and related strategies.

The Power of Compound Interest: Unlocking the Benefits for Long-Term Wealth

Everyone is trying to achieve financial stability and high social status in this fast-moving world. Although it may seem complicated, we will explain it to you. Compound interest works to your advantage because it pays back your initial investment and is highly profitable, and profits keep increasing over time. So it works like a charm for your money. If you start early, keep your goals clear, and take the time to do things that work in your favor, you can take full advantage of compound interest. Begin your journey to financial security today and unlock the door to a balanced lifestyle and long-term prosperity through the power of compound interest. It doesn't matter how much you invest; what matters is the time you give your investment to grow.

Top 10 Clothing Brands for Quality at Affordable Prices

Identifying apparel nhãnments that are both popular and budget-friendly may be difficult. However, with some research and discovery, you may uncover unknown gemstones that provide attractive items at a reasonable cost. In this article, we intend to discuss the top 10 recognized brands in the textile industry that provide superior quality at an affordable price. These labels are worth considering for your next wardrobe upgrade, whether you're a fashion devotee on a budget or want to receive the most bang for your buck.

How to Save Money on College Textbooks: Top Strategies

Educational workbooks may be pricey for students. However, with creative strategies and precise planning, you may reduce the labor cost and your financial burden. This article will discuss ten effective saving methods while maintaining your educational degree. Utilizing these strategies allows you to make sound financial decisions and keep more cash.

Say Goodbye to Debt: A Comprehensive 9-Step Strategy for a Debt-Free Life

Has there been a way to pay your debt with no end in sight? Are the monthly payments causing you more pain than comfort? Do you frequently question how you found yourself in this seemingly impossible trap of financial commitment?

How to Create a Budget-Friendly Travel Plan in 10 Easy Steps?

Are you someone who loves to travel but is always held back by a tight budget? Does the idea of going to a new place, meeting new people, and learning about a new culture light a fire in you, but you feel like travel costs are too high?

Why Investing is Better Than Saving

The ongoing debate about investing versus saving interests those eager to protect their finances during economic uncertainty.

10 Ways To Lower Your Cost of Living Without Moving

Today, in a dynamic and fast-moving society, controlling personal finances is now essential. While moving to a more cost-effective area is often considered a solution, numerous creative strategies can be employed without necessitating a change in life.

8 Common Investment Pitfalls and How to Avoid Them?

Recently, due in part to the pandemic, the investment world has seen a surge of new entrants. Many, including the so-called "investor generation," jumped at the chance to enter the market and explore investment opportunities.

15 Must-Know Financial Terms for Every Investor

Investing in financial markets can be an exciting and rewarding experience, but it can be daunting for beginners. A key factor in investing success is mastering the language of finance.

What is a Bond Mutual Fund

Do you want your money to grow? Bond mutual funds are one of the smartest investments to make. Unlike stocks, bonds are less risky and can provide solid returns. But what exactly are bond mutual funds?

Should You Pay off Debt or Save First

Are you faced with deciding whether to pay off debt or save money first? It's a problem that stems from balancing one financial priority with another.

An Eccentric Guide: What Is Bank Capital?

What is bank capital? When a bank's assets are subtracted from its liabilities, the resulting amount is its capital, also known as its investors' net worth or equity value. Cash, government bonds, and interest-bearing loans comprise the asset component of a bank's capital (such as mortgages, letters of credit, and interbank loans). Provisions for loan losses and other liabilities are included in the liabilities portion of the bank's capital. You can think of a bank's capital as the point at which it would still be able to service its liabilities if its assets were to be liquidated.

Turning Your Hobbies That Make Money

Are you looking for a lucrative hobby? If so, then you are not alone! Many people enjoy hobbies, but only sometimes those that pay off. Fortunately, many hobbies can turn into significant sources of income. Whether you're a creative, an entrepreneur, or a born con, a hobby can become lucrative. The key is to view hobbies as opportunities rather than as hobbies you do for fun.

How to Choose the Right Real Estate Stock for Good Returns

Do you want to diversify your investment portfolio? Investing in different commodities and funds can be an excellent place to start. But something else can generate results, like a stock investment. For long-term investors that want a consistent return, stocks from large and small-cap businesses make sense. But having an entire investment portfolio filled with shares from the same niche is not a sound decision.

How to minimize your risk by diversifying your stock portfolio?

Everyone wants to sell the stock at the same price they bought, perhaps higher. That's when marketing is blooming and booming. But you cannot predict the market's next move, and that's when you need to understand how a well-diversified portfolio is essential in any market condition.

Benefits of Investment Calculator

Allow us to elaborate. Rates of return for our calculators are based on the assumption that you will have a diversified portfolio consisting of equities, fixed income, and liquid assets. The returns on such investments fluctuate and even go down at times. To avoid undersaving, it is best to utilise a low rate of return estimate

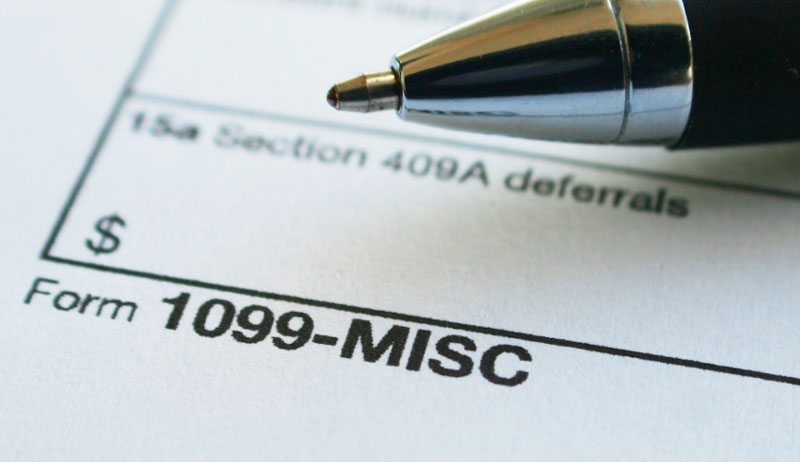

All About 1099 Tax Form

The Internal Revenue Service (IRS) mandates that any independent contractor you employ submit a W-9 form. After that, you have four years to maintain the form in your records. Completed W-9 forms can be submitted to the IRS at your convenience, but doing so is not required

How to Save for Your Child’s Education_ Top Strategies for College Savings

The cost of a college education has steadily increased over the years, and it's no secret that it can put a significant financial burden on families. As per the College Board, the mean expenses of tuition and fees for the 2020-2021 academic year were $26,820 for public, four-year, and in-state institutions and $54,880 for private, nonprofit four-year institutions in the United States. These numbers are expected to continue rising, making it crucial for parents to plan and save for their child's education.

Top 5 Credit Cards With The Best Rewards Programs

As a consumer, choosing the right credit card can be a daunting task. With so many options available, it's important to choose a card that suits your lifestyle and spending habits. One important factor to consider is the rewards program offered by the credit card. This write-up will provide an overview of the ten credit cards that offer the most advantageous rewards programs.

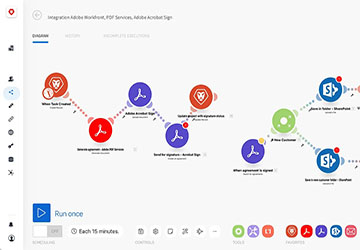

Step by Step Guide to Create an Attractive E-Commerce Website

Many people wanted to run their own businesses, but it was difficult before the internet. Anyone with a computer, internet access and willingness to d

Tips to Improve Your E-Commerce Order Management

As more and more organizations look to conduct business online, the goal should be to improve order processing and delivery.

The Advantages and Disadvantages of Purchasing an Existing Business

It takes a lot of courage to be an entrepreneur. Small business owners are expected to spend a lot of time and complete a variety of tasks that requir

5 Mistakes in E-Commerce Websites That Can Reduce Growth of Your Business

Online businesses face more competition as their business grows. Even if you have the best product on the market, it's not enough to be successful

6 Tips for Balancing Risk _ Reward in Your Portfolio

Finding the right balance between risk and reward is the key to successful investing. A too-conservative portfolio may not generate the returns you need to achieve your financial goals, while too aggressive may expose you to unnecessary risk.

7 Simple Steps to Mastering Dividend Investing

Do you want to generate steady passive income and grow your wealth over time? Dividend investing could be the answer you're looking for!

How to Build a Winning Investment Portfolio from Scratch

If you want to build a portfolio from scratch? You are at the right place!

How to Invest Like a Pro in a Volatile Market

Investing in a volatile market can feel like a roller coaster ride, as the constant ups and downs can leave you feeling uncertain and insecure about your financial future.