Ordinary shares and preferred shares. Pros and cons

Stocks are not created equal. Listed companies usually issue preferred stock and common stock, both of which have their own advantages and disadvantages. In order to better understand each type, we will look at their advantages and disadvantages.

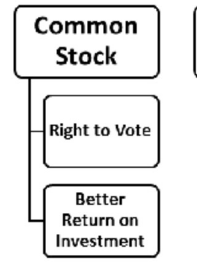

Common stock

Common stock is more than just common in its name; it is the most popular stock among investors. Shareholders have ownership, and they can vote on key decisions (such as decisions related to the election of the company's board of directors). Of course, some policy and management decisions are also made based on their opinions. One vote is usually allocated to each share. Compared with the value of preferred stocks, the value of common stocks often comes more from the rise in stock prices over time than dividends.

In the case of liquidation of common stock shareholders, the long-term growth potential of common stock exceeds the lower priority for dividends and payments. Suppliers, lenders, preferred shareholders and debtors are ranked first in the order of payment. On the other hand, the risk of zero preference shares is much lower.

Long-term investors are more likely to benefit from common stock.

advantage

It gives voting rights.

There is no upper limit to how high the stock price can rise.

Before the stock is sold, capital gains are exempt from tax.

shortcoming

Market volatility

There may be no dividends.

Preferred shareholders receive dividends first, followed by ordinary shareholders.

In the case of liquidation, preferred shares have priority over ordinary shares.

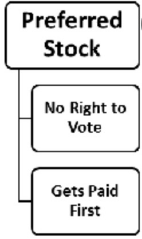

Preferred stock

In the case of preferred shares, shareholders will receive a fixed dividend, and if the shares are repurchased, they will have priority over ordinary shares. Most investors don't necessarily choose preferred stock, despite its name.

Preferred shares are similar to bonds in many ways. If you are looking at preferred stocks, dividends are usually the main source of return. The rate of return on these investments is usually higher than that of common stocks. Like bonds, preferred stocks perform better when interest rates fall. When talking about preferred stock, the term "face value" refers to the value of the stock when it was first issued, and the value that the preferred stock is usually redeemable when it expires.

It is possible to set a predetermined date for the "redemption" of preferred shares (ie redemption by the company). Therefore, the price of a call option may be higher than the price paid by investors. Preference shares can be converted into a predetermined number of common shares, but not vice versa. This is a unique feature. Convertible preferred stock is the name of this type of stock.

Short-term investors who cannot hold common stock for a long time to withstand market declines may find preferred stocks to be a better choice. Preferred stocks are less volatile than ordinary stocks, but their long-term growth potential is not as good as the latter.

advantage

The payments received are higher than the dividends paid by common stock. '

Low risk of devaluation

In the case of liquidation, dividends are received before ordinary shares.

shortcoming

Restrictions on share price growth usually only apply to redemption value

Voting rights are not always granted.